Segment your suppliers

We often suggest staging your onboarding. Businesses often start with their larger-volume suppliers, or if they know who, those who are already eInvoicing enabled. This is often a quick win and can provide insights to improve the process with your other suppliers. For example, stage 1 could be those already eInvoicing enabled and setting a timeline of up to three months.Find out more about your suppliers’ eInvoicing capability

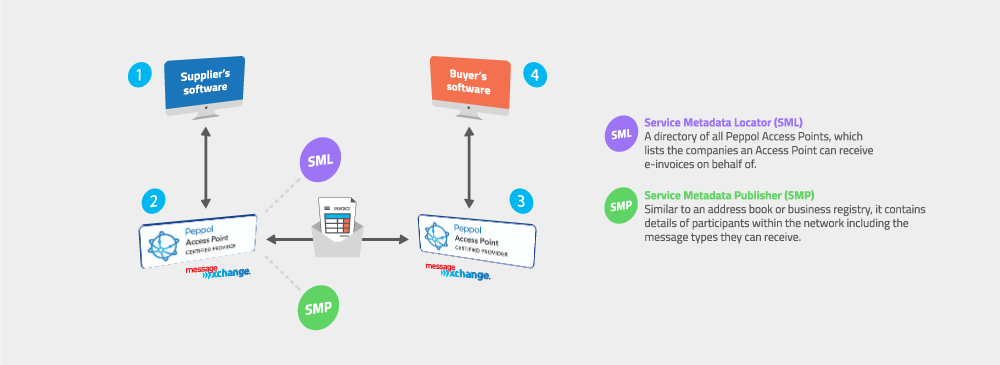

It pays to find out what software your suppliers are using. By finding this out you can learn if the software they’re using is eInvoicing capable already. There are a few ways you can do this:- Take a look at the emails they use to send you PDF invoices today

- Survey your suppliers

- Search for you supplier’s ABN or NZBN in the Peppol directory.

Prepare your communications

You’ve segmented your suppliers now it’s time to get in touch with them. It’s important to use different channels and focus on educating your suppliers and giving them time to prepare. So in your communications you should include a few things:- what eInvoicing is and what the benefits are

- explain how they can get started, mention what software is eInvoicing enabled and don’t forget we provide a free service, Colladium

- be clear about what you need them to do like the date you want them to start sending eInvoices and the fields they need to include

- stick to simple terminology

- promote incentives that you can offer suppliers to entice them to implement eInvoicing.

Now, start writing

There are a few types of communications that you need to put together. You have a communication for each of these stages:- First email describing what eInvoicing is and the benefits and what’s next in the eInvoicing implementation.

- Another email about when you’re ready to onboard a supplier

- When a supplier hasn’t started sending eInvoices

Go beyond just email communications

Get help from others

Determine the touch points of your suppliers within your business – your procurement team, your finance team, account managers or someone else. Educate these people so they know what eInvoicing is, its benefits to your suppliers and any other important information, so they can reiterate the message when speaking with suppliers. Not only does this help with creating more transparency of the process internally but also helps get more insights from those who are dealing with suppliers on a day to day.Use various communication methods

Think about using communications methods such as:- Webinars to teach suppliers what eInvoicing is, its benefits and how to get started. It could be worth even going through the process for those who use the major accounting packages, so they can see just how easy it is.

- Create an email signature that reminds suppliers to send eInvoices.

- Adding a note to your purchase orders, like a banner in the PDF and/or a message in the email you send, is a good way to get the message across to the right person.

- Add a page on your website about eInvoicing.

Consider your business-as-usual plan

You’ll need to consider your business-as-usual plan, or your plan for onboarding new suppliers. Make sure to include that eInvoices are used so this is clearly communicated to new suppliers.Want to learn more about onboarding suppliers to eInvoicing? Get in touch with our team below or download the our whitepaper here.Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.