Comparing eInvoicing and EDI

[vc_column_inner width="1/3"][vc_column_inner width="1/3" css=".vc_custom_1565315132956{padding-top: 0px !important;padding-bottom: 0px !important;background-color: #1b75bb !important;}"]eInvoicing

[vc_column_inner width="1/3" css=".vc_custom_1611113508563{padding-top: 0px !important;padding-bottom: 0px !important;background-color: #00b7f1 !important;}"]Electronic Data Interchange

[vc_column_inner width="1/3" css=".vc_custom_1611114167707{padding-top: 0px !important;background-color: #eeeeee !important;}"]Message Types

[vc_column_inner width="1/3" css=".vc_custom_1610680779980{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]- Invoices

- Invoices

- Purchase Order (PO)

- Purchases Order Response (PORs)

- Purchase Order Acknowledgement (POAs)

- Advance Shipping Notice (ASNs)

- And more

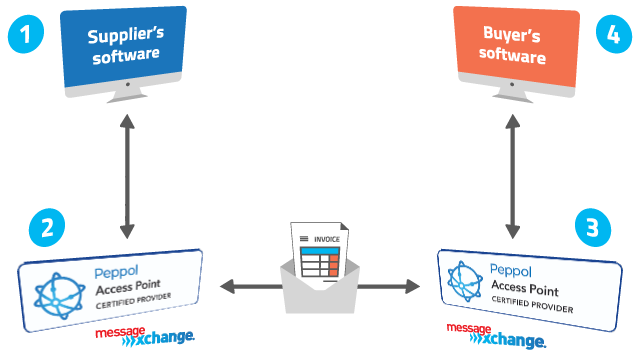

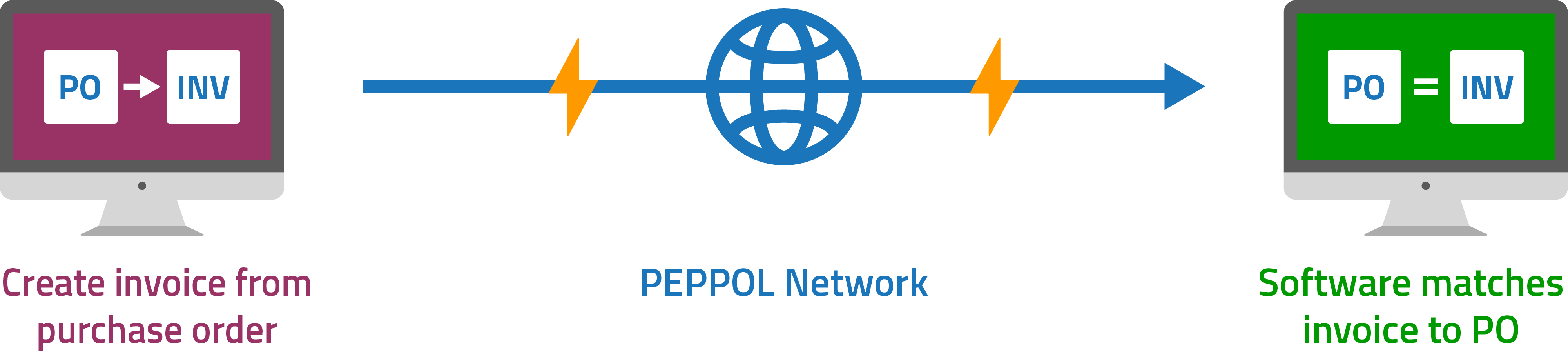

Governance

[vc_column_inner width="1/3" css=".vc_custom_1610681251599{padding-top: 0px !important;padding-right: 15px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Four corner model using Access Points It uses a standardised framework, Peppol[vc_column_inner width="1/3" css=".vc_custom_1611113989632{padding-top: 0px !important;padding-right: 20px !important;padding-bottom: 0px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Value Added Network (VAN)

It uses a standardised framework, Peppol[vc_column_inner width="1/3" css=".vc_custom_1611113989632{padding-top: 0px !important;padding-right: 20px !important;padding-bottom: 0px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Value Added Network (VAN)

- Separate network providers that send EDI messages in the correct format to recipient.

- Common standards include EDIFACT, XML ANSI X12, EANCOM

Security

[vc_column_inner width="1/3" css=".vc_custom_1610681542175{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]- This is set by the Peppol authority

- Access Points must comply with security requirements or can have access revoked.

- Security is set according to EDI standard used and each company and VAN’s security requirements.

Connection protocols/message file format

[vc_column_inner width="1/3" css=".vc_custom_1610681542175{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]- Any connection protocol and file format can be used between you and your Access Point

- Universal Business Language (UBL) and AS4 is used between Access Points

- Any connection protocol and file format – often determined by one party

Which is better for you

EDI

This technology has been around for a long time. As a result, it has become the norm in a few different industries. Some of the main industries include retail, groceries and logistics. Businesses that operate in an industry that EDI is commonly used, should consider using EDI. EDI can send more message types compared to eInvoicing. For businesses looking to take their digital technology further and automate their entire supply chain, EDI could also be the choice for you.eInvoicing

eInvoicing is great for businesses looking for a quick way to automate their invoicing processes. If you send and receive a lot of invoices, and aren’t really concerned about other data in the procurement chain, eInvoicing could be the right choice for you. eInvoicing is also useful for businesses that work with government agencies. As more government agencies move to eInvoicing it’s likely they’ll onboard their suppliers too. You can also benefit from 5 day payments for contracts less than $1 million from government agencies that are eInvoicing enabled.Want to learn more about these two technologies? Request a call with one of our eInvoicing or EDI experts today.Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.

MessageXchange offers businesses a free portal,

MessageXchange offers businesses a free portal,