Newsletter

Sign up to get the latest eInvoicing updates

Stay up-to-date with industry news, useful blogs and whitepapers, expert tips and more.

16/02/2021

Stay up-to-date with industry news, useful blogs and whitepapers, expert tips and more.

12/02/2021

Just fill out your details below and we'll be in touch within one business day.

04/02/2021

Just fill out your details below and we'll be in touch within one business day.

03/02/2021

Stay up-to-date with industry news, useful blogs and whitepapers, expert tips and more.

27/01/2021

Just fill out your details below and we'll be in touch within one business day.

21/01/2021

eInvoicing

[vc_column_inner width="1/3" css=".vc_custom_1611113508563{padding-top: 0px !important;padding-bottom: 0px !important;background-color: #00b7f1 !important;}"]Electronic Data Interchange

[vc_column_inner width="1/3" css=".vc_custom_1611114167707{padding-top: 0px !important;background-color: #eeeeee !important;}"]Message Types

[vc_column_inner width="1/3" css=".vc_custom_1610680779980{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]Governance

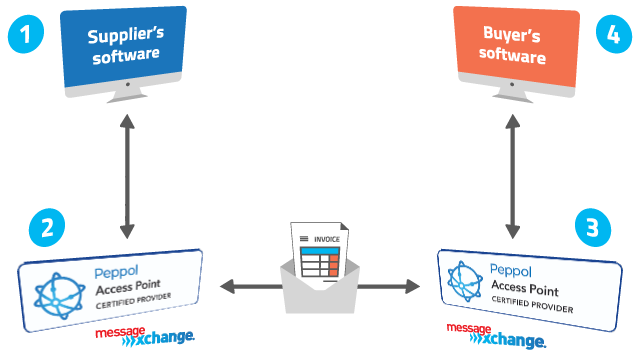

[vc_column_inner width="1/3" css=".vc_custom_1610681251599{padding-top: 0px !important;padding-right: 15px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Four corner model using Access Points It uses a standardised framework, Peppol[vc_column_inner width="1/3" css=".vc_custom_1611113989632{padding-top: 0px !important;padding-right: 20px !important;padding-bottom: 0px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Value Added Network (VAN)

It uses a standardised framework, Peppol[vc_column_inner width="1/3" css=".vc_custom_1611113989632{padding-top: 0px !important;padding-right: 20px !important;padding-bottom: 0px !important;padding-left: 15px !important;background-color: #eeeeee !important;}"]Value Added Network (VAN)

Security

[vc_column_inner width="1/3" css=".vc_custom_1610681542175{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]Connection protocols/message file format

[vc_column_inner width="1/3" css=".vc_custom_1610681542175{padding-top: 0px !important;padding-right: 0px !important;padding-left: 0px !important;background-color: #eeeeee !important;}"]Just fill out your details below and we'll be in touch within one business day.

19/01/2021

Just fill out your details below and we'll be in touch within one business day.

15/01/2021

Just fill out your details below and we'll be in touch within one business day.

10/01/2021

Let us know what you want to achieve and we'll suggest the best solution

[vc_column width="1/4"]Start our partnership

[vc_column width="1/4"]Connect to MessageXchange and test connectivity and messaging

[vc_column width="1/4"]Go live!

If you’re interested in implementing integrated EDI for your business, request a call back below.Just fill out your details below and we'll be in touch within one business day.

16/12/2020

Just fill out your details below and we'll be in touch within one business day.

15/12/2020

Just fill out your details below and we'll be in touch within one business day.

25/11/2020

Select a product and complete your application form

[vc_column_inner width="1/3"]Connect to MessageXchange and test connectivity and messaging

[vc_column_inner width="1/3"]Connect to MessageXchange and test connectivity and messaging

Just fill out your details below and we'll be in touch within one business day.