If you’re just getting started, eInvoicing jargon can be hard to understand. So we’ve put together some of the key words to help make it easier for you.

ABN

This stands for Australian business number. It’s a unique number that identifies a business in Australia. It helps identify your business to others when ordering and invoicing. And in the eInvoicing world, it’s a number you can send and/or receive eInvoices from/to.

Access Point

eInvoicing is done through a four-corner model. You can think of it like a phone network, where your network service provider, and the service provider of the person you’re trying to call, are the Access Points. Access Point are the service providers that connect to each other.

API

This stands for application programming interface. It’s a messaging protocol. An API is a way for others to push information to you, or retrieve information from you. And by you, I mean your software.

AS4

This stands for applicability statement 4. It’s a messaging protocol. AS4 can exchange messages in near-real time and supports the ability to send back delivery notifications, so the sender knows their message has been received. It’s considered highly secure and has high availability, meaning it’s always active to be used.

B2G

Stands for business-to-government. it refers to business that’s conducted between a business and government Business level response (BLR)

A business level response can be sent from a company to their supplier once they receive an invoice. It can give the supplier an update on the invoice, like whether it’s been accepted, rejected, paid, queried, or something else.

CSV

This stands for comma separated values. It’s a file format. Think of it like very simple Excel spreadsheet. In fact, you can open these files in Excel.

Electronic data interchange (EDI)

Electronic Data Interchange (EDI) refers to the structured transmission of data between organisations electronically. It’s used to transfer documents electronically from one system to another i.e. from one trading partner to another trading partner.

eInvoicing

It’s the exchange of eInvoices in a structured, electronic format. It’s not be confused with sending a PDF invoice. PDFs aren’t machine-readable. eInvoices are sent directly from one software package to another.

ERP system

This stands for enterprise resource planning system. In simple terms, it’s what most businesses use to manage their accounts payable and receivables. Generally, ERP systems are a little more complex than your typical accounting package. Think of SAP, Oracle, Pronto and more.

File format

This refers to the way information in a document is stored and organised. PDF, JPG and PNG are all file formats. When it comes to eInvoicing, file formats are relevant because your software will export and import a certain type of file format. You might also see the acronym UBL used a bit. That’s the file format, or standard, used for eInvoices when they’re sent between Access Points. It’s not an issue if your software doesn’t export and import a UBL file – a well-rounded eInvoicing provider will be able to map your file format to and from the UBL format for you.

Four corner model

eInvoicing happens through a four-corner model, where corners one and four are the supplier and customer, and corners two and three are Access Points. Access Points connect to each other to exchange eInvoices.

Gateway

Our customers will generally have their own ‘gateway’ on the MessageXchange service. All of your business’ requirements are setup in your gateway, like mappings, reports and more. Your software connects to your gateway, and your gateway connects to the outside world. All eInvoices you send or receive will go through your gateway.

GLN

This stands for global location number. They’re a unique number given to a location, usually a business address, to identify it. They’re heavily used in electronic data interchange (or EDI) trade. GLNs are issued by your local GS1 organisation.

Interoperability

The ability of diverse systems and companies to work together.

Mapping

Mapping refers to translating, or converting, one file format to another. For example, if your software outputs a file format that isn’t the Peppol standard, UBL, your eInvoicing service provider may be able to ‘map’ the file so it conforms.

Message level response (MLR)

Whereas a business level response (BLR) is issued once a business receives the invoice and is, or is about to process it, a message level response is often issued before it can even get to the recipient. The Peppol standard has certain requirements, and if these aren’t met, an invoice may be rejected. A message level response lets the sender of an eInvoice know if the message has been rejected because of an error within the message. One example is that the syntax is incorrect.

MessageXchange

MessageXchange is an eInvoicing service provider. Find out more at messagexchange.com

Messaging protocol

In simple terms, a messaging protocol is a way to get files, or messages, from A to B; from software to software. Think of it like transport. If you wanted to get from Sydney to Melbourne, you can fly, drive, take a bus or a train. Each have their pros and cons. Just like each messaging protocol have their benefits. Some examples of messaging protocols are sFTP, API and AS4. The messaging protocol a company chooses to use will largely depend on what their software is capable of using, how much the company would like to invest in it, what level of security they need and the features they need, for example whether they need to exchange messages in near-real time or not.

NZBN

This stands for New Zealand business number. It’s a unique number that identifies a business in New Zealand. And in the eInvoicing world, it’s a number you can send and/or receive eInvoices from/to. An NZBN is in fact the same as a GLN.

Order-to-pay

The combined end-to-end trade process from the buyer’s perspective (order, delivery, invoice and payment).

Peppol

Peppol stands for Pan-European Public Procurement On-Line. It’s a standard of e-procurement, which we use in Australia and New Zealand to exchange eInvoices. When we say ‘standard’, it stipulates how Access Points should connect with each other, the file format invoices should be sent in and more. Having one standard makes it easier for businesses to trade with multiple organisations, because they can connect once and exchange eInvoices with anyone else in the Peppol network.

Purchase order

Document sent by a buyer to a supplier to inform them that they wish to purchase goods, services or works.

Service provider

A service provider that connects to a supplier and buyer directly. The supplier connects to the service provider which enables them to connect to multiple buyers and/or suppliers. Think of it like a phone service provider like Telstra or Optus, but this service provider is for eInvoicing.

sFTP

This stands for SSH (or secure) file transfer protocol. It’s a messaging protocol. You can think of it like a mail box; files are dropped into an sFTP folder (think of a folder on your desktop), often in batches, and they’re picked up by whoever is receiving the files. All of this is usually done automatically by having a process run periodically in the background. As you can probably tell, sFTP transfer is doesn’t support real-time messaging. But, it is one of the cheapest and easiest messaging protocols to use.

SML

This stands for service metadata lookup. Sounds complicated, I know. But think of it like a phone book of sorts. Access Points use the SML when they receive an eInvoice, to look up where it should go. The SML lists ABNs, NZBNs, GLNs that have registered for eInvoicing, as well as the Access Point provider that company uses. Have a look at the diagram on page 3 to see how it fits in.

SMP

This stands for service metadata publisher. Once an Access Point gets the information needed from the SML, it then asks the relevant SMP what documents that company can receive. If the company has registered to receive that type of document, the Access Point will send it on. Have a look at the diagram on page 3 to see how it fits in.

Syntax

Syntax refers to the rules that define the structure of the code of a message. Without going into too much detail, some of you might have seen basic code like text here. This tells the software where the element begins, the value of an element, and where that element ends. For example, on an invoice it might look like Cupcakes. Access Points will expect a message structured in a certain way, that is, using the correct syntax. In the eInvoicing world, if the syntax is incorrect, the Access Point receiving the message should send back a message level response (MLR).

UBL

This stands for universal business language. You probably won’t need to worry too much about this if you’re not in an IT role. It’s a file format. Just like you might use a JPG, PNG or GIF image file format.

XML

This stands for extensible markup language. It’s a file format. It looks like code to us, but holds all the information in a structured, machine-readable format.

If you want to learn more about eInvoicing, sign up to our newsletter to get the latest information and useful resources.

Newsletter

Sign up to get the latest eInvoicing updates

Stay up-to-date with industry news, useful blogs and whitepapers, expert tips and more.

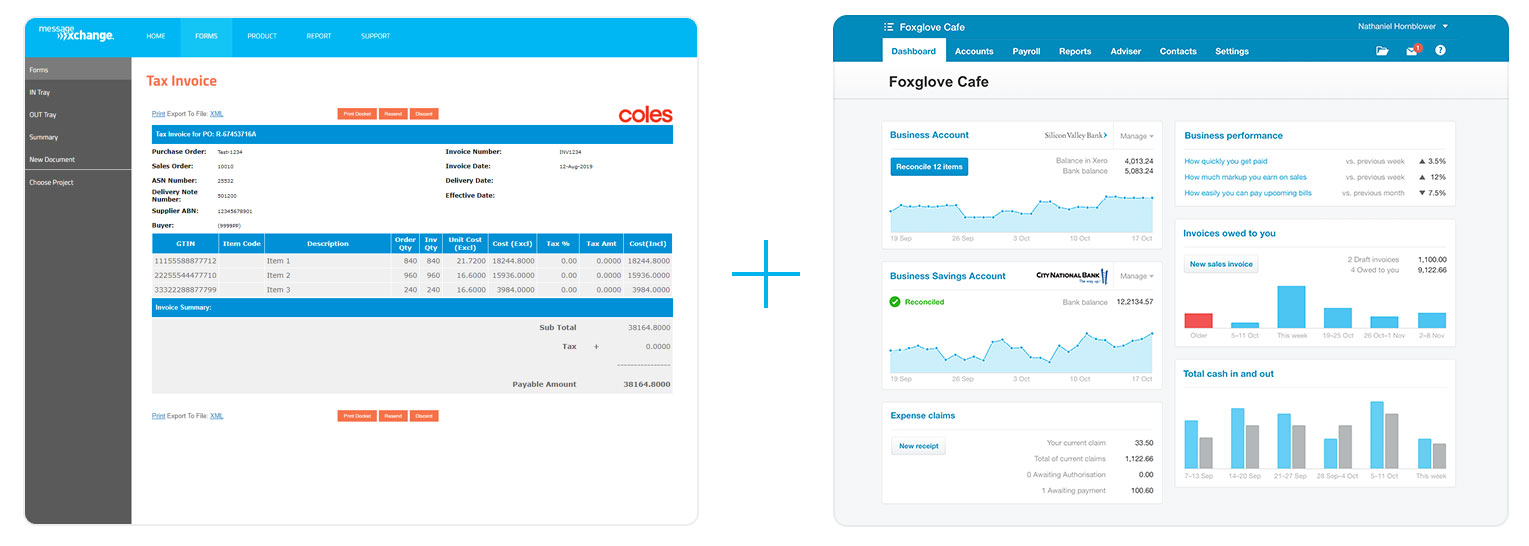

If you choose to go with our FormXchange product, you can even automate the process one step further. By turning on the integration between FormXchange and Xero, you can sync the invoices you enter in the EDI portal (FormXchange) directly to Xero, so your invoices are always up-to-date in your accounting software.

That means whenever you send an invoice to your customer on FormXchange, a copy will go to them, as well as to your Xero account. It’s that simple.

If you choose to go with our FormXchange product, you can even automate the process one step further. By turning on the integration between FormXchange and Xero, you can sync the invoices you enter in the EDI portal (FormXchange) directly to Xero, so your invoices are always up-to-date in your accounting software.

That means whenever you send an invoice to your customer on FormXchange, a copy will go to them, as well as to your Xero account. It’s that simple.