In the ever-expanding digital landscape, two powerful tools, Electronic Data Interchange (EDI) and Application Programming Interfaces (APIs), are pivotal in shaping how data is exchanged in the business world. While these technologies serve distinct purposes and have unique characteristics, they also share common goals.

Understanding EDI

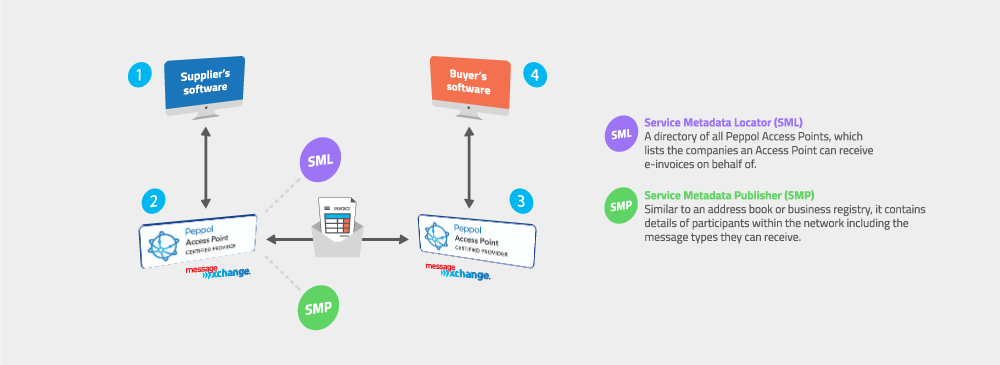

Electronic Data Interchange (EDI) is a well-established message standard for exchanging structured business documents between trading partners. EDI has been a trusted format for decades and is often used in supply chain management, particularly in industries like retail, manufacturing, and healthcare. Here's a brief overview of EDI:

- Structured format: EDI uses structured data formats, such as EDIFACT or X12, which define the layout and content of documents.

- Legacy system integration: EDI excels at integrating with legacy systems, making it valuable for industries with established practices.

EDI messages can be sent and received over any protocol (including APIs) in real-time and in batch.

Understanding APIs

Application Programming Interfaces (APIs), in contrast, haven’t been around quite as long as EDI. APIs are sets of rules and protocols that enable different software applications to communicate with each other in real-time. APIs have opened the possibility of industries of all types to start connecting business systems and data.

Finding common ground

Now that we've explored the key differences between EDI and APIs, we should recognise their shared objectives:

- Data exchange: Both EDI and APIs are used for exchanging data efficiently and accurately between systems and organizations.

- Efficiency: They aim to streamline processes, reduce manual data entry, and minimise errors, ultimately improving operational efficiency.

- Business integration: Both technologies promote business integration, allowing different systems to work harmoniously together.

- Enhanced communication: Whether through structured formats (EDI) or other connections (APIs), both solutions enhance communication between systems and trading partners.

In the world of data exchange, EDI and APIs are two formidable players, each with its unique strengths and capabilities. Often they are both pitted against each other but the reality is that both can be utilised together. APIs can be used with EDI and we are seeing more and more business take advantage of this. We frequently connect to customers' ERP systems via APIs to exchange EDI messages in real-time. Our Gateway solution has the flexibility to work with all types of connection protocols whether it’s API or another. Some of the key positives of a MessageXchange gateway, include:

- One central connection between systems, mediating between systems, connection protocols, file formats and trading partners/businesses.

- Having full visibility of data exchange activity

- Ability to transform and manipulate data

- Ability to see errors and act, or build in escalation processes.

Want to learn more about how MessageXchange can help with your data integration needs? Ask our experts by getting in touch below.

Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.