Convincing senior management is key to getting a project off the ground. After all, they’re usually the business sponsor. If you’ve identified that EDI is going to benefit your business, here are some tips to convince your senior managers that you need EDI.

Put together a business case

The key thing is to highlight the cost savings of EDI – to show them the impact it’ll have to the bottom line. Here are a few calculations you can use:

Orders

Calculate the cost of sending a purchase order to your supplier.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

(time it takes to put together email or postage

x

orders sent

x

hourly rate)

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

+

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

printing related costs

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

+

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

postage costs

The cost of suppliers processing the orders incorrectly.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

number of orders incorrectly processed

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

time it takes to rectify the incorrect entries

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Invoices

Costs of processing an invoice for payment.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

time it takes to enter invoices into software

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of invoices

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Costs of fixing incorrect invoice payments.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Time it takes to fix errors in invoices

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of invoice payment errors

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Warehouse

Costs of updating incorrect data[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Time it takes to update inventory in system

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of orders with incorrect data

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Once you’ve done that you can use these figures to work out your expected ROI.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Savings

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

÷

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

(establishment costs + running costs)

* These calculations are to be used as a guide only

Get buy in from other departments

Having the support of internal departments can be what helps a project over the line. There are a few departments in particular that play a big part in the EDI implementation and ongoing processes.

IT

EDI integrates with your software, so your IT team will help with a lot of the technical aspects. Thinking of ways to make their lives easier will go a long way, so ask them:

- If they’ll need new hardware or software?

- If they’ll need additional resources to implement EDI?

- If your EDI provider adheres to your security policy?

Buying or procurement

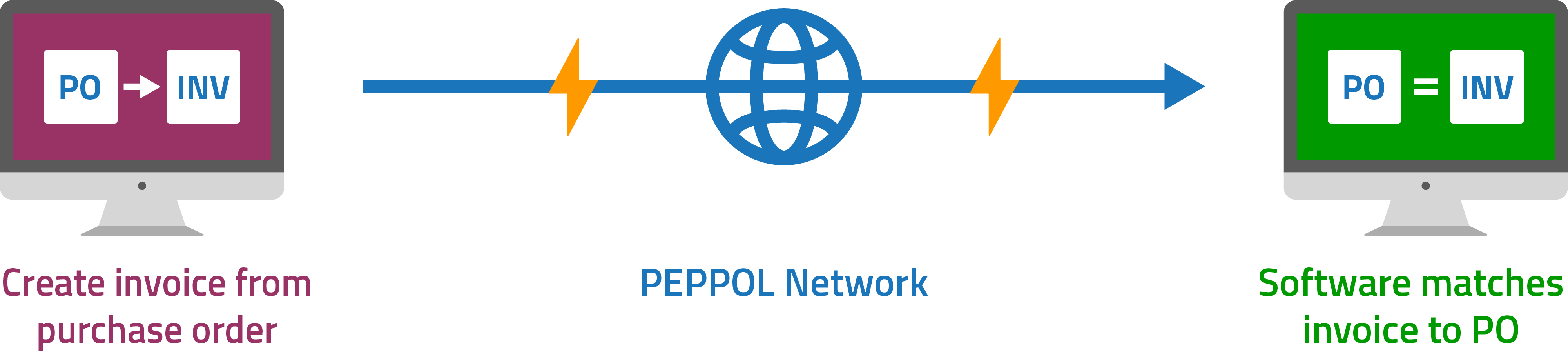

The buying or procurement teams will probably be concerned about any impact to their ordering process. EDI uses your existing software and automates the exchange of purchase orders, invoices and other messages. Make sure to show them how EDI will simplify their tasks, such as:

- Providing them with more information like what can be fulfilled and when the order will arrive.

- Faster stock fulfilment because suppliers will receive orders almost instantly.

Finance

When convincing your finance team, focus on promoting the benefits of EDI. It reduces the amount of manual inputting required and can automate a lot of their processes, leading to:

- fewer errors: less time and costs to fix mistakes

- reduced costs: no need to printing and archive paper invoices.

- more time, allowing staff to work on higher value tasks

- more accurate data for decision making.

All of this, in turn, can lead to significant cost savings.

Develop a solid plan

Having a plan will give management confidence that you’re on the road to success. Here are three things to include:

The implementation plan

The most important thing in your plan is to set deadlines for each deliverable. At the end of the day, management will want to know when it’ll be completed so they can ensure a solid return on investment. It’s also worth outlining the team members involved in each stage of the process. This’ll provide transparency for everyone involved.

Staff training

EDI will require some change (a good change!) in your business so a little training will help everyone come along on this journey and make sure they feel equipped to handle the change. The training should cover new processes, such as:

- how accounts staff will process payments to suppliers?

- how buying teams raise purchase orders?

- how warehouse staff process deliveries?

It’s also worth adding back up plans to your training to cover the unlikely scenario of an outage to your EDI service. This is also useful for management to show how operations will continue.

Onboarding suppliers to EDI

The amount of trading partners you onboard is paramount to a good ROI. Having a plan for onboarding suppliers will improve the success and also provide confidence for your management teams. Check out our

10 steps to successful community onboarding to learn more.

So summing up...

Getting buy in from management can be daunting but there are a few things that can help.

- Show off potential savings from EDI.

- Show you have buy-in from other departments.

- Develop a plan with dates of key deliverables.

- Keep management up-to-date with progress as you go.

If you want to learn more about how EDI can help your business, get in touch with our team.

Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.