Getting buy in to your EDI project from others in your business can be a challenge. But it’s a crucial step. Having the buy in from others will give you have support along the way and help make your EDI implementation smoother.

We have extensive experience in helping businesses achieve success with their EDI projects. As a result, we’ve come up with some things to think about when engaging with various parts of your business to help you get their buy in. When going through the business, show your colleagues that you’re prepared. And remember to show them what’s in it for them.

Management

Often management is the first part of the business you need to get onboard. So, if you haven’t already been asked by management to undertake your EDI project, here are some things to think about:

Building your business case

It can be difficult to know where to start with your business case for EDI. When calculating your cost savings make sure you include:

Orders

Calculate the cost of sending a purchase order to your supplier.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

(time it takes to put together email or postage

x

orders sent

x

hourly rate)

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

+

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

printing related costs

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

+

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

postage costs

The cost of suppliers processing the orders incorrectly.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

number of orders incorrectly processed

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

time it takes to rectify the incorrect entries

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Invoices

Costs of processing an invoice for payment.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

time it takes to enter invoices into software

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of invoices

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Costs of fixing incorrect invoice payments.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Time it takes to fix errors in invoices

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of invoice payment errors

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Warehouse

Costs of updating incorrect data[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Time it takes to update inventory in system

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

number of orders with incorrect data

[vc_column_inner width="1/12" css=".vc_custom_1584660587092{padding-right: 10px !important;padding-left: 10px !important;}"]

X

[vc_column_inner width="1/4" css=".vc_custom_1584660687060{padding-right: 0px !important;padding-left: 0px !important;}"]

hourly rate

Once you’ve done that you can use these figures to work out your expected ROI.[vc_column_inner width="1/4" css=".vc_custom_1584660745420{padding-right: 0px !important;}"]

Savings

[vc_column_inner width="1/12" css=".vc_custom_1584660555829{padding-right: 10px !important;padding-left: 10px !important;}"]

÷

[vc_column_inner width="1/4" css=".vc_custom_1584660670420{padding-right: 0px !important;padding-left: 0px !important;}"]

(establishment costs + running costs)

* These calculations are to be used as a guide only

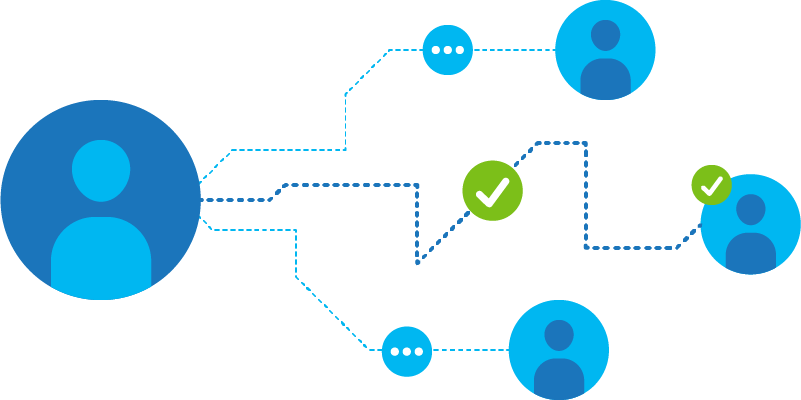

Partner onboarding plan

Getting partners onboard to EDI is critical for the success of any EDI project. Providing a plan to management can often provide assurance to them that ROI will be maximised. Make sure to include how you intend to segment and onboard suppliers. Check out our guide,

10 steps to successful community onboarding.

Information technology (IT)

Your IT team will be one of the impacted groups when you implement EDI. To get their buy in, and to make their lives easier, think about these things:

- Will they need to buy or install any new hardware or software?

Some solutions require new hardware or software to be installed. Here at MessageXchange, we don’t require our customers to install any new hardware or software. We simply connect to your existing software.

- Will they need to additional resources to implement EDI?

This is dependent on the EDI solution you use. With our technology, your software only needs the ability to import and export messages and exchange them via a secure connection protocol. Check with your IT team whether they can currently do this. If not, what resources will they need?

- Does the provider adhere to your security policy?

IT teams are often aware of security risks to your internal systems. Put their mind at ease by showing what measures your EDI provider takes to keep your data secure. MessageXchange is ISO 27001 certified and having developed the software from inception, owns its intellectual property.

Finance

Another area of the business that you need buy in from is the finance department. Costs on the business are a big factor so it’s important to show the savings that will be gained from EDI.

Finance teams will also benefit from the use of EDI. It greatly reduces the amount of manual inputting required and can automate a lot of their processes, leading to:

- improved efficiency, allowing staff to work on higher value tasks

- fewer errors: less time and costs to fix mistakes

- reduced costs: no need to printing and archive paper invoices.

- more accurate data for decision making.

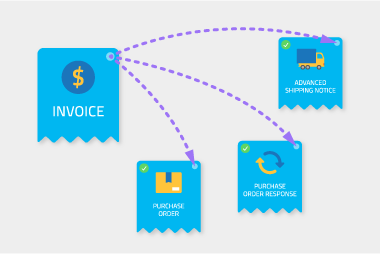

Accounts payable

EDI can simplify accounts payables through two- or three-way matching. Rules can be put in place to check the invoice, delivery information and/or purchase order information for accuracy. This saves the accounts payable team time manually looking for documents before approving payments. Some suppliers offer early payment discounts for paying invoices early.

Accounts receivable

An added bonus for your accounts receivables team is reduced payment times. Studies show that EDI can reduce payment times by as much as 20%. This means improved cashflow for your business.

Buying/procurement

One concern for the buying and procurement teams is the impact it may have on their ordering process. EDI uses your existing software to produce and send the purchase orders to your suppliers. Usually the only change to your existing procurement process is that you won’t need to put together PDFs and emails or send purchase orders via post. Plus, through the use of purchase order responses and despatch advices, your teams will have more information at their fingertips like what can be fulfilled and when the order will arrive. And EDI orders can reach your suppliers almost instantly, so you’re more likely to get the stock faster.

Warehouse

Once you’ve implemented EDI, your business operations teams will be able to get the most out of the data received through EDI. Advanced shipping notices (ASNs) or despatch advices will get your warehouse teams delivery information before the goods arrive so they can organise the warehouse crew for receiving goods. This information can then be used to update your inventory levels in your warehouse management systems. The data from EDI can also be used to monitor your suppliers’ performance against KPIs with more accuracy.

Planning

EDI will mean some change for businesses so it’s often best to have a training plan for all departments. This should cover what's being changed in processes, such as:

- how accounts staff will process payments to suppliers?

- how buying teams raise purchase orders?

- how warehouse staff process deliveries?

On top of having a training plan, a contingency plan in place will also improve buy in and trust throughout the business. This assures departments of what to do if, in the unlikely scenario, something goes wrong.

Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.

MessageXchange offers businesses a free portal, Colladium, which can be used to send eInvoices to businesses on the Peppol network.

MessageXchange offers businesses a free portal, Colladium, which can be used to send eInvoices to businesses on the Peppol network. There are a number of benefits to an integrated eInvoicing solution:

There are a number of benefits to an integrated eInvoicing solution:

Before getting started with eInvoicing you will need to make sure your software is ready. Here are some things you should ask your invoicing software provider. Your Access Point may need this information to get you setup.

Before getting started with eInvoicing you will need to make sure your software is ready. Here are some things you should ask your invoicing software provider. Your Access Point may need this information to get you setup.

There are a few things you should think about when looking at Access Point providers. These include:

There are a few things you should think about when looking at Access Point providers. These include: