More than 1.4 billion invoices are sent every year in Australia and New Zealand. With that in mind, it is easy to understand why people, especially those in the Australian Government, see eInvoicing as a game changer.

What is eInvoicing?

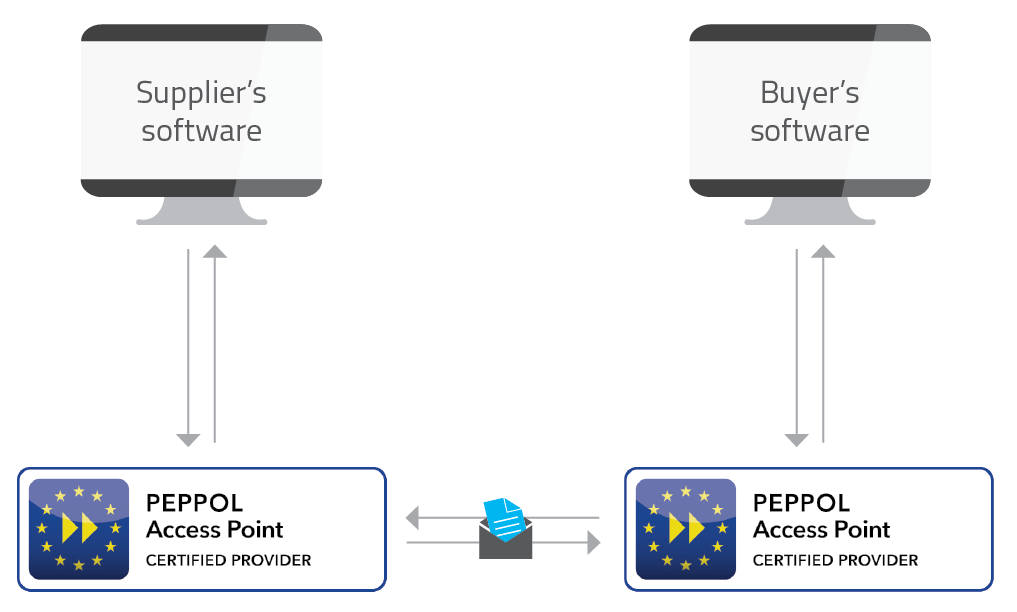

eInvoicing enables organisations to send and receive invoices electronically, directly to and from their software. It removes the need for unnecessary data entry and inaccurate OCR scanning. The eInvoicing model is based on four-corners, where corners one and four are the supplier and customer two and three are Access Points. These Access Points connect to each other to exchange eInvoices.

You might also hear about Peppol in relation to eInvoicing. Peppol is a standard for eInvoicing, developed by OpenPEPPOL, an international standards body. It defines the eInvoice message format, as well as connection protocols and governance.

The Peppol network is also able to exchange more than just eInvoices. Purchase orders are being reviewed and localised for Australia and New Zealand with more expected to be launched in the future.

What are the benefits of eInvoicing?

- Easier invoice processing

- Cost savings

- Faster invoice payments

- Fewer errors

- Exchange of invoices directly to and from software

- Secure

- Available for businesses of every size

- 60–80% more efficient than paper-based processing

- Could save Australia and New Zealand more than $10 billion a year

- The US Government has already seen eInvoicing save them more than US$450 million in processing costs alone.

A round up of developments so far:

- In March 2018, the Australian and New Zealand governments agreed to look at common approaches to eInvoicing under the Single Economic Market (SEM) agenda. This was formalised on the 25th of October 2018 when the Australian Assistant Treasurer and the New Zealand Minister for Small Business signed the Trans-Tasman Electronic Invoicing Arrangement.

- In February 2019, both governments announced their intention to adopt the Pan-European Public Procurement Online (Peppol) interoperability framework for eInvoicing.

- In November 2019, the Australian Government announced that as of the 1st of January 2020, contracts valued up to $1 million will be paid in five days or face interest on late payments, as long as both the seller and the agency use eInvoicing.

What’s in the new eInvoicing legislation?

On the 29th of October 2019, legislation became effective allowing an Australian Peppol authority to be established by the Australian Taxation Office (ATO). The ATO put in their application to OpenPEPPOL to begin the membership process and was announced as a Peppol member on the 31st of October. Around the same time, the Ministry of Business, Innovation and Employment (MBIE) become the New Zealand Peppol Authority.

As a result of the new legislation, the ATO and MBIE can now start to certify Access Points in Australia and New Zealand respectively. The ATO has begun working with software and eInvoicing solution providers to get the ball rolling. This is an important development as it means Australian and New Zealand businesses can connect and start to send invoices through the eInvoicing network as soon as Access Points have been certified.

What does this mean for you?

To access the eInvoicing network and start reaping the benefits of eInvoicing, businesses will need an Access Point. Software providers should find their own Access Points, or if your software doesn’t have an Access Point, you can find one directly.

You can choose to become an Access Point yourself by going through the certification process with Peppol or you can work with an Access Point provider, such as MessageXchange, to connect you to the eInvoicing network. Working with an Access Point provider is the easiest and quickest way to connect to the network, and in many cases is the most cost efficient. Some Access Points can also translate files into the Peppol eInvoicing format.

For software providers: Now is the time to start engaging Access Points to get your customers ready for eInvoicing.

For businesses: Speak to your software provider to find out their plans for eInvoicing. If they’re not providing an Access Point, start getting in touch with Access Point service providers to prepare for eInvoicing.

Newsletter

Sign up to get the latest eInvoicing updates

Stay up-to-date with industry news, useful blogs and whitepapers, expert tips and more.