There are a few things businesses need to think about when implementing EDI. One of the key ones is your business objectives – why you’ve chosen to use EDI in the first place. This will dictate how you go about your planning and implementation. Your business objectives will also determine what messages you exchange with your partners.

What types of EDI messages are there?

EDI can go far beyond a purchase order and invoice. Some common messages are:

- Purchase order

Sent from buyer to supplier to order goods or services

- Purchase order change

Sent from buyer to supplier if the original purchase order has changed

- Purchase order acknowledgement

Sent from the supplier to the buyer to acknowledge receipt of the order

- Purchase order response

Sent from the supplier to the buyer to let them know how much of the order can be fulfilled, and any discrepancies from the original order

- Advance shipping notice (or despatch advice)

Sent from the supplier to the buyer to let them know when and how the goods will be shipped

- Invoice

Sent from the buyer to the supplier for payment of the goods or services

- Recipient created tax invoice (RCTI)

Sent from the supplier to the buyer for payment of the goods or services

- Remittance advice

Sent from the buyer to the supplier to confirm payment

- Price/sales catalogue

Sent from the supplier to the buyer with up-to-date product and pricing information

- Product activity data

Sent from buyer to the supplier with the number of units sold and units on hand

- Transport instruction

Sent from a buyer to a transport supplier (and related parties) to communicate transport arrangements

- Transport response

Sent from a transport provider to confirm instructions

- Functional acknowledgement

An automated response sent from a receiver of an EDI message to confirm receipt of the message.

What messages should you use?

Your objectives will influence the messages you should choose. Here are some examples:

If you’re trying to reduce manual handing

…the messages you should consider using are:

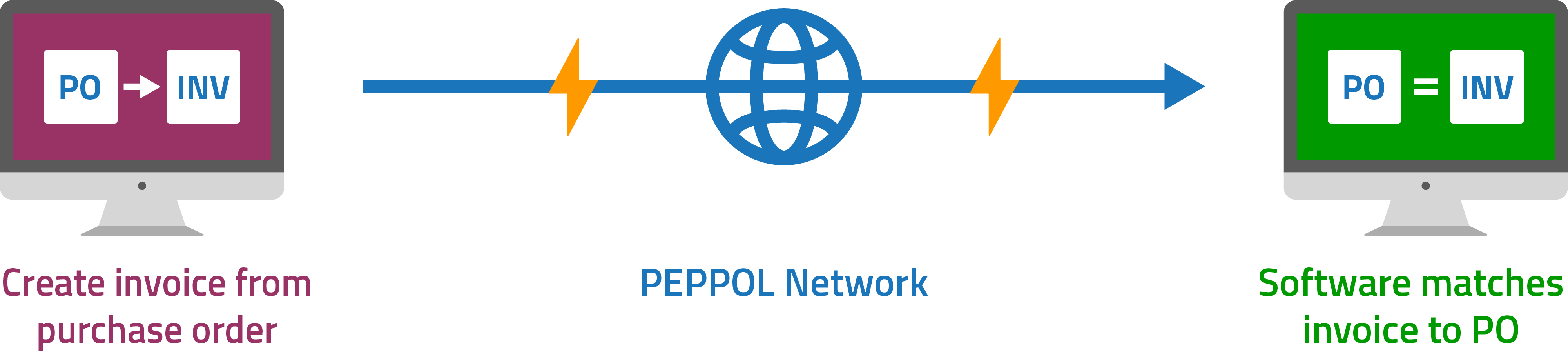

This means all invoices will come directly to your software electronically. No more need for your team to enter an invoice manually. You might ask why use a purchase order too. It’ll make it easier for your customers to receive orders, and will mean that they don’t have to manually enter them on their side. It usually leads to less errors throughout the process.

If you’re wanting to receive stock faster

…consider sending your purchase orders via EDI.

By simply sending out a purchase order through EDI, it should get to your supplier significantly faster. They probably don’t regularly check their emails which can delay processing. It also means they don’t need to spend time entering it into the systems on their side.

If you’re after visibility of fulfillment

…the messages you should use are:

- purchase order

- purchase order response.

The purchase order is sent directly to your supplier’s software. And the purchase response is sent by your supplier to confirm whether your order can be fulfilled, and if it’s only being part-filled, it’ll tell you how much they can supply. These messages give full visibility of your order fulfillment.

If you’re trying to get better, more accurate information

…use a combination of:

- purchase order

- purchase order response

- despatch advice and

- or all of them.

A purchase order response will let you know ahead of time what the supplier will be able to send you. It helps you plan ahead if your whole order can’t be fulfilled. It also helps with data inaccuracies you might have. For example, if you don’t have the correct prices, you can let your suppliers amend prices on the purchase order response, which you can approve or not, before they despatch the goods.

A despatch advice lets you know what’s coming, when and how. And getting the invoice electronically means your team don’t need to spend time re-entering it. All of the data from these can be used for reporting on supplier performance and more.

An EDI invoice will mean you don’t have to re-enter the invoice data when it gets to you, which means less data entry mistakes.

If you’re trying to get better, more accurate information

Drop shipping is a popular business model for a lot of retailers. There are a few messages that can help you move to this model:

- Purchase orders (PO)

- Purchase order acknowledgement (POA)

- Advanced shipping notice (ASN)

The PO gets the order to your suppliers as quickly as possible. The POA and ASN gives you visibility of where the order is at, and can even let you pass tracking information onto your customer.

If you want to receive deliveries more smoothly

There are two messages can help achieve this objective:

- Purchase order (PO)

- Advanced shipping notice (ASN)

Sending a PO gets your order to your supplier reliably. The ASN will let you know when to expect the delivery so your team is on hand to receive it. You can also use the SSCC labels to scan stock in to automate the receiving of goods.

If you want real-time data at your fingertips

There are a few messages that can help achieve this objective, including:

- Purchase order (PO)

- Purchase order response (POR)

- Advance shipping notice (ASN)

- Invoice

- Sales forecast

- Price/sales catalogue

The POR lets you know as soon as the supplier sends it, what they can supply. An ASN will let you know what’s being shipped, how and when. An invoice will help you see an accurate business position and liabilities. And price/sales catalogue makes sure you’ve got the most up-to-date data of the products you’re ordering. Never order with the wrong prices again.

If you’re still struggling to decide what messages to use, have a chat to one of our experts. Request a call back below.

Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.