We’re beginning to see a big change in the way we do invoicing in business. What used to be a very manual, paper-based process is now becoming automated and digital with the introduction of eInvoicing.

What is eInvoicing? To put it simply, it is the electronic sending and receiving of invoices in a structured data format directly between software applications. This isn’t sending a PDF and or sending an email, eInvoicing is software to software and 100% automated. By comparing traditional invoicing and eInvoicing we can see just how efficient eInvoicing can be for both buyers and sellers in the following areas:

- Processing and payment

- Costs

- Visibility, transparency and accuracy of information

- Security

Processing invoices

Traditional invoicing

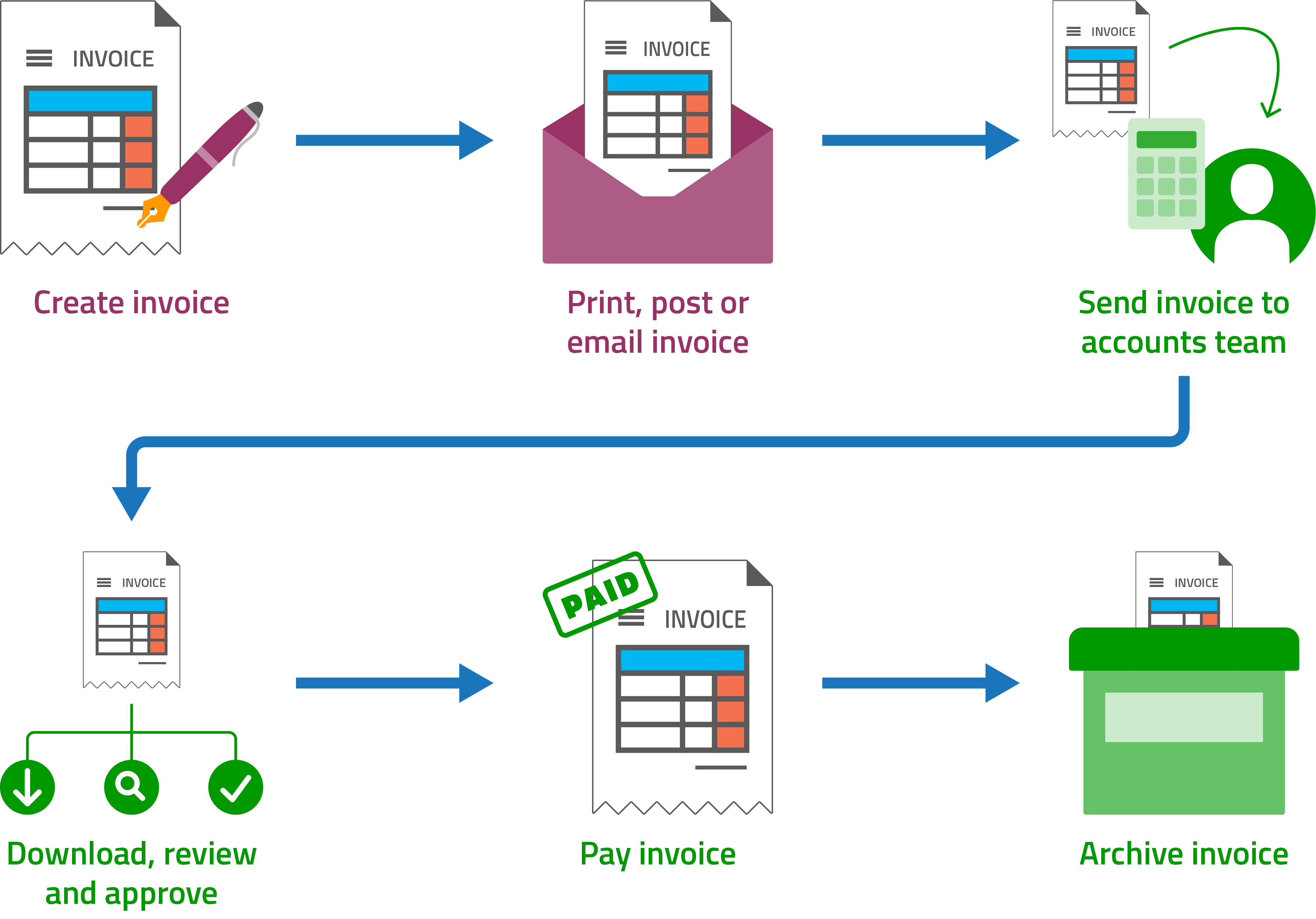

In traditional invoicing, the process of creating invoices and receiving payments can be lengthy. Often it looks like this:

- Create the invoice

- Print and post it (or send via email)

- Buyer receives and sends it to their accounts team

- The invoice is downloaded, reviewed and approved

- The invoice is paid

- The invoice is archived.

The process involves a lot of manual handling and re-keying of information, causing errors in invoice data, slowing processing and running the risk of invoices being sent to the wrong person or company. Traditional invoicing is also very labour and time intensive, so when staff are working on multiple tasks, the process can be slowed down even further.

All these elements can create huge delays in payments and reduce cash flow for sellers, which is especially problematic for smaller businesses. Overall, paper invoices are estimated to take 23 days to process when the process runs smoothly. This can blow out to up to 90 days when they run into errors.

eInvoicing

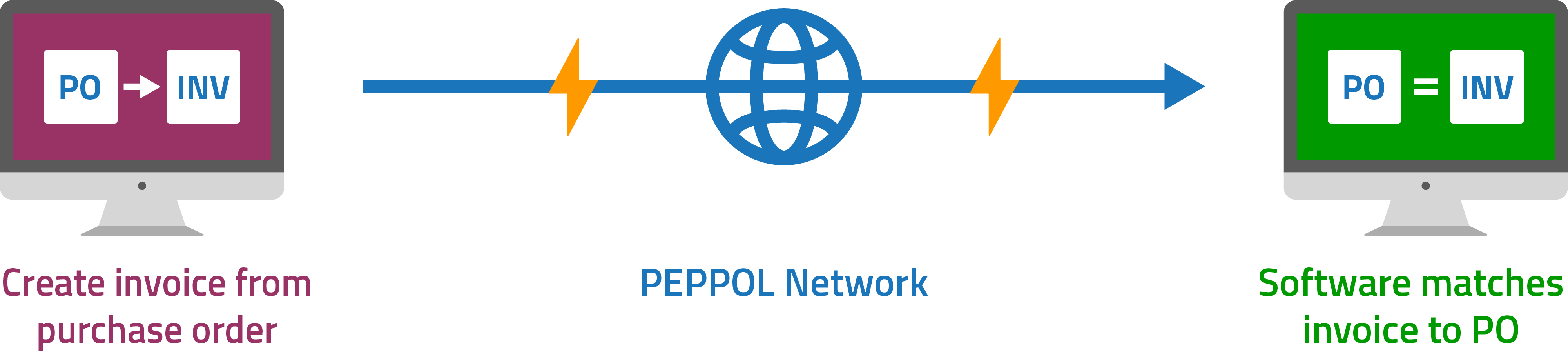

eInvoicing works a bit differently. It looks like this:

- The seller finds their purchase order (PO) in their software and creates an invoice. The information is brought across from the PO. The seller sends the invoice electronically from their software. The invoice is sent, almost magically, through Peppol network directly to buyer’s software.

- The buyer’s software matches the received invoice against the PO for payment authorisation.

The process is streamlined through automation for both the seller and buyer. The issues presented by traditional invoicing are eliminated by significantly reducing redundant manual processing. eInvoicing has been shown to be 60-80% more efficient than paper-based processing greatly reducing payment times. One source calculates the average for processing an eInvoices is just 5 days . By reducing processing times with eInvoicing, sellers receive payment faster and buyers streamline their processes and business operations.

Costs

Traditional invoicing

There are a few different costs that are attributed to the traditional invoicing processing. For both buyers and sellers, the main costs are:

- Printing: even if using PDFs, invoices may be printed. Costs include paper, ink and even printer maintenance.

- Labour: you need people to process invoices and this only increases as your business grows.

- Postage

- Filing

Overall, costs have been estimated to be $30.87 to process a paper invoice and $27.67 for PDF invoices.

eInvoicing

Costs are much lower when we look at the costs associated with eInvoicing. Many traditional invoicing costs are reduced or eliminated altogether because of reduced manual processing and electronic sending. It’s been calculated that eInvoices are approximately 70% cheaper than traditional invoicing. On top of this, buyers can often stick to the payment terms of their suppliers, reducing late fees and even benefiting from early payment discounts.

Visibility, transparency and accuracy of information

Traditional invoicing

Traditional invoicing can require multiple platforms and software and sometimes complicated physical and electronic filing systems. This can make it very difficult to manage, maintain and retrieve records. This can make reporting harder, which impacts the accuracy of your business performance results and the data used in decision making.

eInvoicing

eInvoicing allows you to use a single piece of software for creating and processing invoices. This makes it much easier for businesses to have visibility and transparency of their payables and receivables. The need for collating information from multiple systems and paper documents is significantly reduced. As well as this, the reduced risk of errors from manual processing increases the accuracy of data.

Security

Traditional invoicing

There are a number of security issues that can occur from traditional invoicing.

- Fake or comprised invoices: details on invoices can be changed or altered without knowledge from either party.

- Billing scams and fraud: invoices can be sent to misleading sources, causing money loss.

This is commonly because the formats the documents are sent in allow them to be easily altered. Plus, sending invoices through mail or email means they’re easily intercepted, sent to the wrong person, or send fraudulently.

eInvoicing

eInvoicing uses the Peppol network, which requires buyers and sellers to have a certified Access Point send and receive invoices. The Peppol network adheres to a secure and reliable framework that all parties must comply with. eInvoices are sent in a pre-defined format which can’t be changed or altered. Archiving using eInvoicing is much easier to track, improving your audit trail.

Comparing both traditional invoicing and eInvoicing shows significant efficiencies when using eInvoicing. If you’re interested in finding out how eInvoicing could work for your business, request a call from one of our experts today!

Request a call

Chat with one of our experts

Just fill out your details below and we’ll be in touch within one business day.