- improved cash flow and quicker payments

- easier processing and cost savings

- fewer errors

- direct and secure messaging

- available for every business size.

What’s in it for software providers?

Retaining and acquiring customers

One of the clear reasons is retaining existing customers and the potential to acquire new customers. Software providers are always looking for ways to provide more functionality and improve features for their clients. Becoming eInvoicing-capable increases existing functionality for their customers. It also provides additional value to help software providers differentiate themselves from competitors.Allow customers to trade seamlessly internationally

The Peppol eInvoicing network currently has 33 countries using the standard, allowing businesses around the globe to send and receive trading documents such as eInvoices. This means software providers that become eInvoicing-capable also allow customers to trade seamlessly with partners overseas. This is a huge benefit for existing and potential customers who currently trade internationally. This also benefits businesses looking to expand around the world.Early payments from the Australian Government

The Australian Government has announced its plan to make payments within five days for contracts under $1 million from January 2020. This is set to increase demand for eInvoicing, which makes it a big potential market for software providers. Many smaller suppliers will be looking to implement eInvoicing to benefit from of this incentive. The Australian and New Zealand Governments’ push to move more suppliers to eInvoicing will also help drive demand in the region. As larger businesses look to connect to the eInvoicing network, demand will grow even further. Globally, we are seeing 20% growth annually in eInvoicing uptake.What is the process for software providers to integrate?

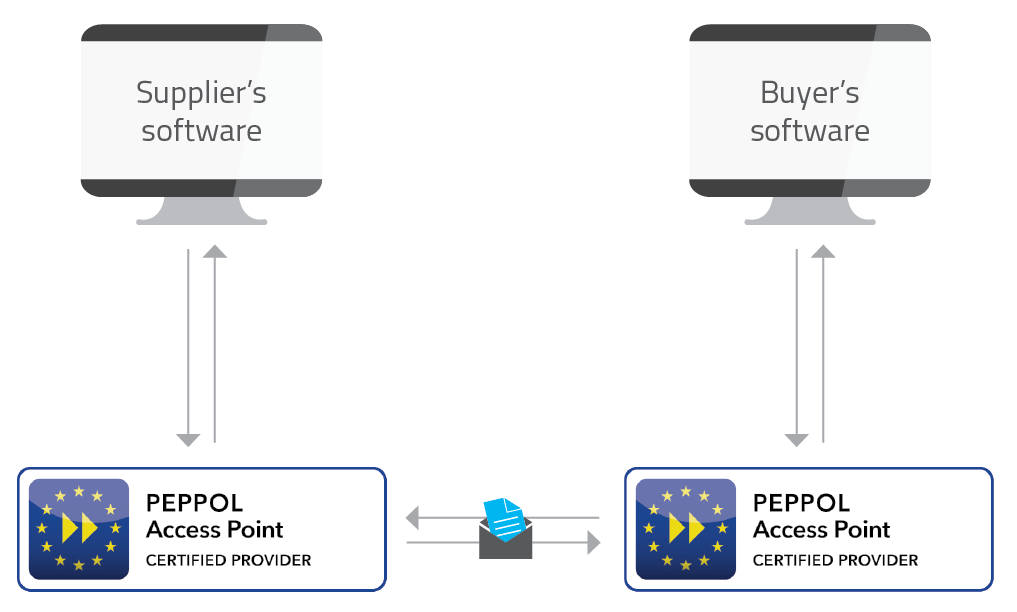

There are a number of options for software providers to make their products eInvoicing-capable. The process normally consists of:- Choose an Access Point

Access Points connect companies to the Peppol eInvoicing network. They send and receive the messages and pass them on to the recipient’s Access Point. There are options when it comes to Access Points:

- Choose to become an Access Point yourself by going through the certification process with Peppol and local Peppol authority.

- Work with an Access Point provider, such as MessageXchange, to connect you to the eInvoicing network. Working with an Access Point provider is often the easiest and quickest way to connect to the network, and in many cases is the most cost efficient.

- Determine your file format

The Peppol eInvoicing network exchanges messages in the Peppol standard. There are two ways to comply:

- Produce the Peppol file format from your software.

- Work with an Access Point provider to translate your software file to a Peppol compliant file.

- Error messaging As part of sending and receiving eInvoices, you’ll need to be able to display any error messages. You can choose to show these error messages in your own software. Some Access Points offer a solution for displaying error messages that don’t require development on your side.

- Customer onboarding In order to enable your customers for eInvoicing, their organisation details will be needed for the Access Point to register businesses. In Australia and New Zealand, the ABN and NZBN are needed to uniquely identify organisations when sending and receiving eInvoices.

Request a call

Chat with one of our experts

Just fill out your details below and we'll be in touch within one business day.